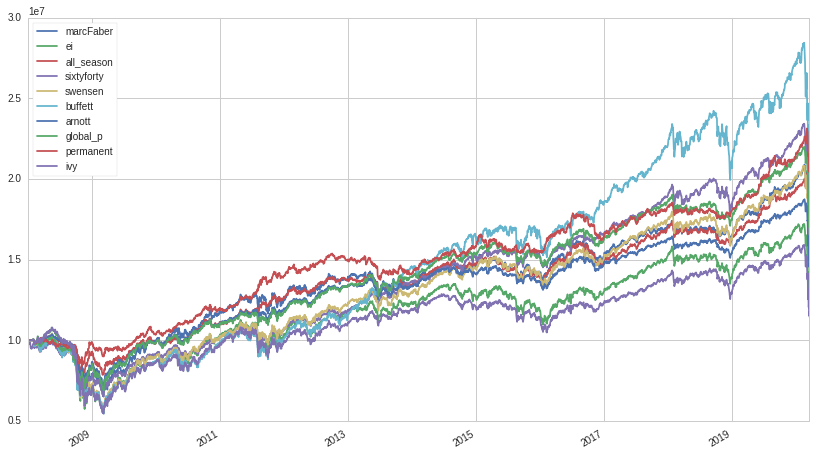

In this series, I am going to show what could happen if we do follow several different asset allocation portfolios. Because these portfolios cover a wide range of asset classes, I think the easiest way to mimic the returns of the various asset classes and types is to buy and hold their respective ETFs. However, these passive ETFs are sprung up at different points in the history of ETFs. To make the comparison amongst these portfolios fair, the time period of the comparison test has to cover all the asset classes ETFs. To this end, the test starts on Jan 3, 2008 and ends on March 20, 2020.

All portfolios are rebalanced on the first day of the months.

The reference material I have used is from an e-book titled Global Asset Allocation: A survey of the world’s top investment strategies by Meb Faber. The backtests are performed on Quantopian platform. Unfortunately, this platform is no longer available today. My personal experience tells me that Quantopian has offers very useful tools to test out different strategies including those seeking alpha.

I have looked up the expense ratio of these ETFs and included in the table below.

| Asset type | Asset class | ETF tickers | ETF expanse ratio |

|---|---|---|---|

| US Large Cap | Stocks | SPY | 0.09 |

| US Small Cap | Stocks | VB | 0.05 |

| Foreign Developed | Stocks | VGK | 0.09 |

| Foreign Emerging | Stocks | VWO | 0.12 |

| Corporate Bonds | Stocks or Bonds | LQD | 0.15 |

| 1-5 year T-Bills | Bonds | SHY | 0.15 |

| 7+ year T-Bills | Bonds | IEF | 0.15 |

| 10-year Bonds | Bonds | AGG | 0.06 |

| 20-year Bonds | Bonds | TLT | 0.15 |

| 10-year Foreign Bonds | Bonds | EMB | 0.39 |

| TIPS | Real Assets | TIP | 0.19 |

| Commodities | Real Assets | DBC | 0.85 |

| Gold | Real Assets | IAU | 0.25 |

| REITs | Real Assets | IYR | 0.42 |

| source: https://etfdb.com/ | |||

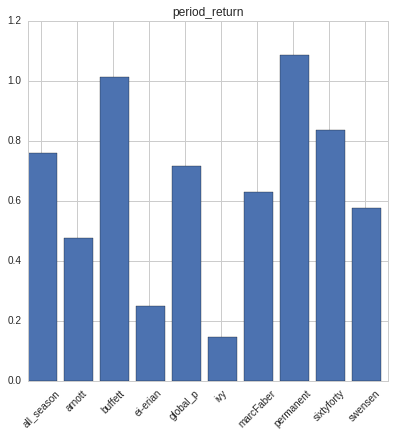

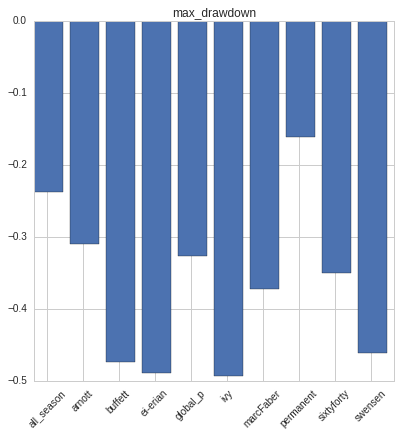

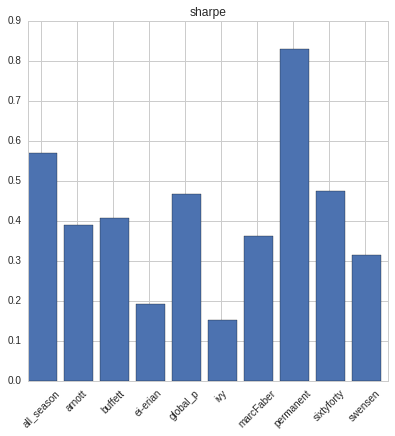

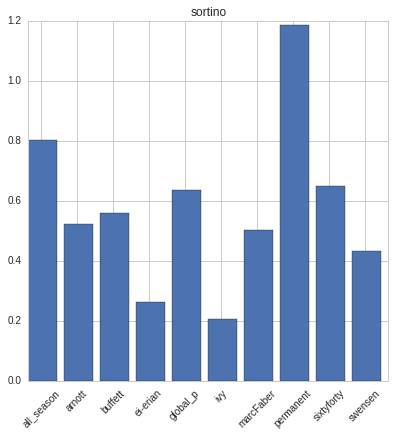

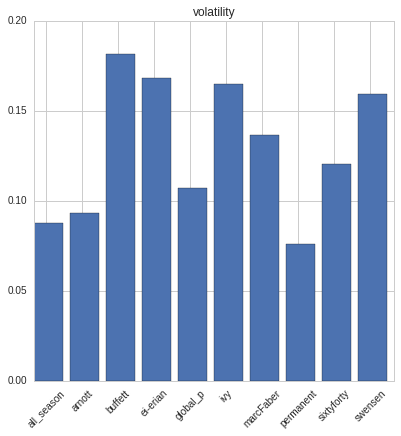

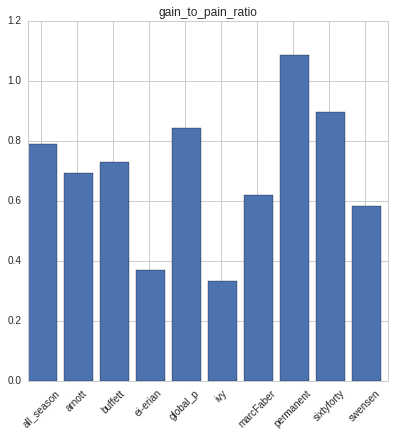

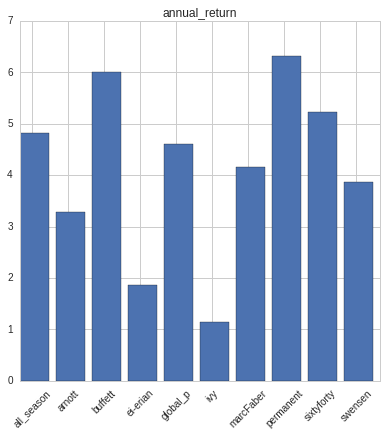

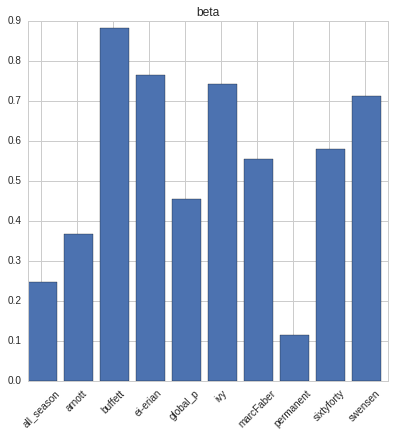

Here is a summary of their risk and return.

|  |

|  |

|  |

|  |

My general observations are that regardless of the mix, they all have their good times and bad times. I agreed with Meb Faber and many others that ETFs’ fees are important. Say an annual fee of 0.5% and if we take an annual return of 4%, the fee eats up 12% of the long-term profit. Furthermore, I think a simple portfolio allocation works just as well if not better than a complicated strategy.

Resources used: Asset_allocation_portfolio_backtesting_python_script